SFST meets Canadian officials

Secretary for Financial Services & the Treasury Christopher Hui met financial officials in Ottawa on Wednesday and business representatives in Vancouver yesterday, as he continued a five-day visit to Canada.

Mr Hui met Canadian Deputy Minister of Finance Chris Forbes on Wednesday. They discussed the challenges posed by unilateralism and protectionism, and how Hong Kong and Canada might collaborate to achieve mutual benefits in areas such as the gold market and virtual assets.

Mr Hui told Mr Forbes that as global economic gravity continues to shift eastwards, Hong Kong has been exploring new growth areas and expanding international co-operation. He said this includes efforts by a working group to promote gold market development.

In a meeting with Canada’s Superintendent of Financial Institutions Peter Routledge, Mr Hui spoke of Hong Kong’s perseverance in upholding a robust regulatory regime across different financial institutions and financial products.

Mr Routledge praised Hong Kong for its advanced development in the area of digital assets, stating that it sets an example for other regions.

Mr Hui then met Senator Woo Yuen-pau at Parliament Hill and brief him on Hong Kong’s effort in maintaining its status as an international financial centre through various measures.

He mentioned the recent affirmations of Hong Kong’s credit ratings by Fitch, S&P and Moody’s, adding that these fully demonstrate Hong Kong’s resilience in maintaining stability amid increasing global economic and financial uncertainties.

During his short stay in Ottawa, Mr Hui also paid a courtesy call to China’s Ambassador to Canada Wang Di.

Mr Wang said Hong Kong has its own distinctive advantages which can enable it to be a bridgehead in driving closer ties between China and Canada in addition to fostering direct co-operation between Hong Kong and Canada.

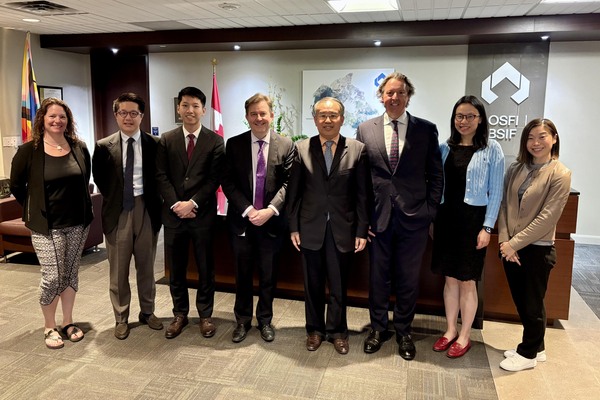

In Vancouver yesterday, Mr Hui met Fraser Institute Board Chair Mark Scott and some other prominent business figures to update them on Hong Kong’s financial development.

Mr Hui welcomed the think-tank’s ranking of Hong Kong as the world’s freest economies in its Economic Freedom of the World 2024 Annual Report.

Later, he spoke at a business lunch hosted by the Hong Kong-Canada Business Association (Vancouver Chapter), and participated in a fireside chat.

Mr Hui then met representatives of the Canadian Imperial Bank of Commerce and briefed them on development in areas such as wealth management and digital assets in Hong Kong.

The day concluded with a business networking reception and seminar organised by Invest Hong Kong (Canada).

Addressing the audience, Mr Hui highlighted the Government’s dedication to integrate Web3 innovations into the real economy by introducing a licensing regime for fiat-referenced stablecoin issuers, and to foster the development of Web3 and digital assets.

He also mentioned Hong Kong’s determination to expand the financial value chain to sustain the world-class status of its financial markets. Two forward-looking moves are to build an international gold trading market and create a commodity trading ecosystem in Hong Kong, he said.

Mr Hui added that, with Canada enjoying a prominent position in the global gold market and the Toronto Stock Exchange being the world’s pre-eminent stock exchange for mining companies, co-operation between Hong Kong and Canada can establish an East-West financial corridor for the world.