Canadian firms urged to re-domicile

On day two of his Canada visit, Secretary for Financial Services & the Treasury Christopher Hui urged two Canadadian-based insurance companies to consider re-domiciling their companies to Hong Kong to enjoy the relevant legal and taxation convenience, as well as to lower their compliance costs for satisfying two sets of regulatory requirements.

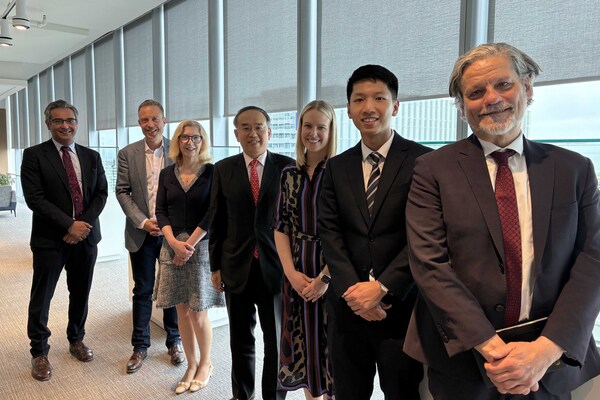

During yesterday’s duty visit, Mr Hui met Manulife President & Chief Executive Officer Phil Witherington and Chief Financial Officer Colin Simpson, as well as SunLife Executive Vice-President & Chief Financial Officer Tim Deacon and Executive Vice-President & Chief Strategy & Enablement Officer Linda Doughety.

Both companies are Canadian-based and have extended their business to Hong Kong.

Mr Hui introduced them to the newly enacted legislation on re-domiciliation of companies, adding that on the very first day the company re-domiciliation regime came into effect last Friday, an international insurance group immediately announced its plan to re-domicile its company to Hong Kong.

He pointed out that this news was the best testament to the regime's effectiveness in enhancing companies' operational efficiency, thereby consolidating Hong Kong's position as a leading international financial centre.

Under the new regime, non-Hong Kong-incorporated companies may apply to re-domicile to Hong Kong if they fulfil requirements concerning company background, integrity, member and creditor protection, solvency, etc, while maintaining their legal identity as a body corporate to ensure business continuity.

If the company's actual similar profits are also taxed in Hong Kong after re-domiciliation, the Government will provide the company with unilateral tax credits to eliminate double taxation.

Mr Hui highlighted that Hong Kong has a strong foundation in investment and trade, making it an ideal location for global enterprises to access insurance, reinsurance and risk management services, as well as to establish captive insurers. He also noted that there are vast opportunities for insurance companies in Hong Kong.

Mr Hui then attended a business luncheon organised by the Hong Kong Economic & Trade Office (Toronto), Invest Hong Kong (Canada) and the National Club.

He gave a presentation themed "Hong Kong as an anchor of stability amid the changing world" to showcase to the attending financial leaders the stellar figures recorded in the financial market, and banking and monetary markets.

Mr Hui talked about the Government's efforts in aligning with international standards and boosting the development of green and sustainable finance and the virtual asset market. He highlighted that with its competitive advantages and proactive measures, as well as the stability and predictability of its financial market, Hong Kong has been earning the confidence of global investors.

Additionally, Mr Hui met Ontario Securities Commission (OSC) Chief Executive Officer Grant Vingoe and both agreed that in today's shifting global landscape, collaboration with trusted allies would ensure capital markets remain robust and resilient.

The Securities & Futures Commission of Hong Kong entered into a memorandum of understanding with the OSC in mid-May to include Ontario of Canada in its list of acceptable inspection regimes for strengthening the regulatory collaboration and exchange of information between the two regulators.

In the evening, Mr Hui had a dinner meeting with Hong Kong-Canada Business Association (Toronto Chapter) President Joseph Chaung, and the association’s board members to brief them on the latest developments and future direction of Hong Kong's financial market.

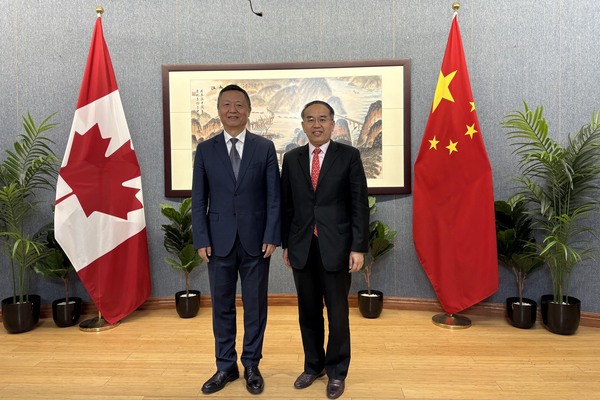

Mr Hui also paid a courtesy call on Consul-General of the People's Republic of China in Toronto Luo Weidong. Both expressed their anticipation that Hong Kong, with the support of the nation and its solid foundation and forward-looking measures in financial areas, will engage in more co-operation with Canada.