SFST begins visit to Canada

Secretary for Financial Services & the Treasury Christopher Hui met representatives of two banks and an insurance group in Toronto yesterday, as he began a five-day visit to Canada.

On arriving in the country, Mr Hui met Royal Bank of Canada’s Wealth Management Group Head Neil McLaughlin, and its Executive Vice President & Global Head, Strategy, Products and Digital Investing Stuart Rutledge.

He then proceeded to Scotiabank to meet its Group Head for Global Wealth Management Jacqui Allard, and its Strategic Cultural Segments Vice President Amit Brahme. Both banks are deeply interested in Hong Kong’s wealth management sector.

Mr Hui outlined that Hong Kong is currently the largest cross-border wealth management hub in Asia, with some anticipating the city will leap into first place globally by 2028.

He added that family offices are an important segment of Hong Kong’s asset and wealth management sector. Private banking and private wealth management business attributed to family office and private trust clients in Hong Kong was valued at US$185.2 billion at the end of 2023.

Mr Hui also spoke about the diversity of financial products in Hong Kong and the recent passage of stablecoin legislation, emphasising that investors have a plethora of options.

He encouraged the two Canadian banks to leverage the strengths of Hong Kong’s asset and wealth management industry and establish a presence in the city.

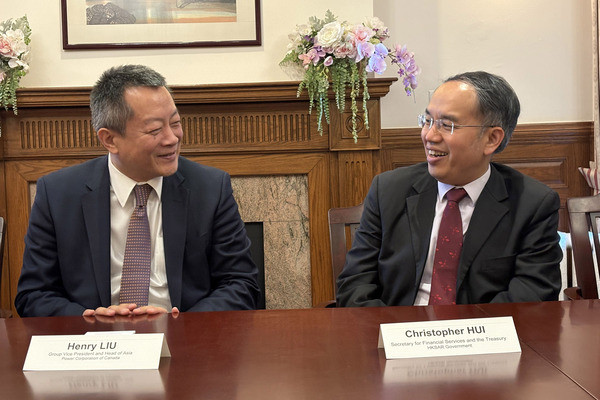

Mr Hui also met Power Corporation of Canada’s Group Vice President & Head of Asia Henry Liu.

He briefed Mr Liu on the facilitation and concessions provided by the Hong Kong Special Administrative Region Government to family offices looking to set up or expand their business in the city. This includes no licence requirement for a single family office under the Securities & Futures Ordinance if it does not carry out regulated business activity in Hong Kong. Single family offices can also enjoy profit tax exemption for qualifying transactions.

Mr Hui also highlighted the Hong Kong SAR Government’s efforts to enhance preferential tax regimes in relation to funds, single family offices and carried interest. The Government intends to submit legislative proposals to the Legislative Council for consideration next year, with an aim to implement enhancement measures from the 2025-26 year of assessment.

Power Corporation of Canada operates a wide range of businesses spanning insurance, wealth management and investment across North America, Europe and Asia. Mr Hui urged the company to leverage Hong Kong’s ideal business environment, stability and predictability to facilitate the setting up of family offices in the city.