FPS to be allowed in Thailand

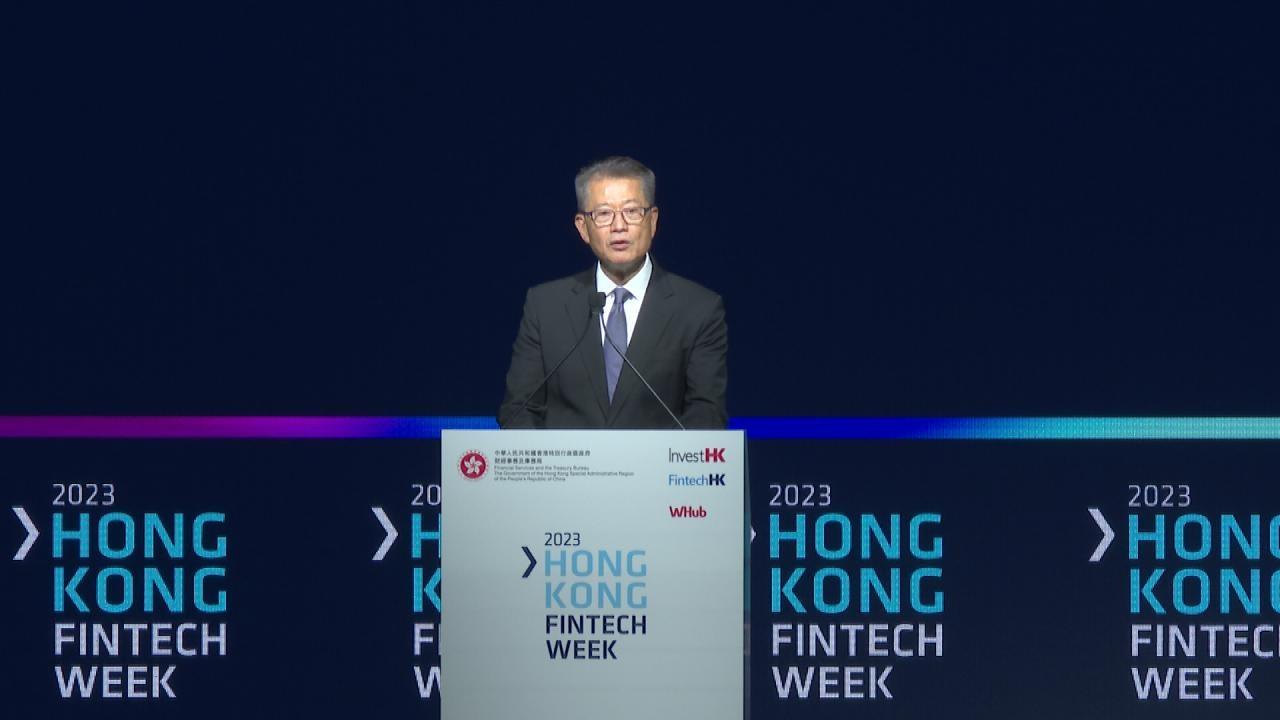

Financial Secretary Paul Chan

I am delighted to be here, once again, for Hong Kong Fintech Week.

What a global gathering this is. I am told that attendance is over 30,000 and participants come from more than 90 countries and regions, with over 30 delegations joining, either in person or virtually.

The theme of this year’s Fintech Week is “Fintech Redefined”. Fintech is not just financial technology’s portmanteau. It is also a catalyst for driving change and innovation, for making financial services more accessible, inclusive, efficient and user-friendly. It is about bringing real impact and tangible benefits to people’s lives.

From livestock financing to pet insurance

The fintech ecosystem here in Hong Kong is, I believe, illustrative of this important undertaking.

At last count, we are home to about 1,000 fintech companies and startups, representing an increase of 25% as compared to the number last year. Many of their founders come from different parts of the world.

But impressive numbers aside, there are different real-life cases showing how our fintech firms are bringing changes and empowering individuals, businesses and the community at large.

One example is what few may associate Hong Kong with: that is, livestock financing.

Traditionally, it would be difficult for farmers, particularly those in remote regions, to obtain loans from financial institutions. But a local tech company in our Cyberport has used blockchain and Internet of Things technologies to develop a real-time system for monitoring the location, health and growth of livestock. The data has provided sufficiently credible information to lenders to accept livestock as collateral.

And in a similar vein, another fintech company nurtured in Science Park is using artificial intelligence and data technology to develop a credit risk model to help small-to-medium enterprises (SMEs) obtain loans without collateral, thereby enabling them to accelerate their growth and development.

Besides, virtual banks in Hong Kong are providing convenient, innovative and competitive services to individuals and SMEs. They have indeed driven traditional financial institutions to move faster in digitalisation and product innovation.

In fact, virtual banks are getting increasingly popular. In a survey conducted by the Hong Kong Association of Banks, the majority of respondents are now seeing virtual banks as convenient, innovative and cheaper alternatives. And more SMEs have begun integrating virtual banking services into their business operations.

You will be delighted to hear that our virtual banks are expanding into markets in Southeast Asia as well. And recently two have made it into the global top 10 in mobile banking applications.

And do not forget the four virtual insurance companies in Hong Kong. They are offering innovative products in areas that may be left out by traditional insurers, like coverage for pets, including dogs, cats and turtles.

During this Fintech Week, through speeches, conversations, presentations, dialogues and business matching, I am sure you will hear more fascinating stories of our fintech firms, and uncover the vast potential and collaboration opportunities that they offer.

A facilitative regulator

Ladies and gentlemen, Hong Kong’s vibrant fintech landscape, I am proud to say, is the result of concerted efforts from the Government, the public sector and the private sector. While our fintech entrepreneurs are innovative, energetic and resourceful, the Government and financial regulators see ourselves not just as a gatekeeper for investor and consumer protection, but also as a facilitator to help entrepreneurs succeed.

That includes facilitative policies and initiatives such as regulatory sandboxes in collaboration with authorities in the Guangdong-Hong Kong-Macao Greater Bay Area to test cross-boundary solutions. That also includes providing seed funding, investor matching, incubation and professional support services for our fintech startups.

And no less importantly, we are actively driving new initiatives to spur fintech development.

An example is the Commercial Data Interchange, or CDI, launched by the Hong Kong Monetary Authority (HKMA) in October last year. It allows companies, particularly SMEs, to share their sales, logistics, transaction and other data with banks on a consent basis, making it easier for them to access loans and other financial services. In one year, CDI had enabled more than 8,900 loan applications and reviews, with an aggregate credit approval amount exceeding $8 billion.

We are encouraging the use of blockchain technology in financial products, and leading by example. The tokenised green bonds issued in February this year were globally the first such bonds issued by any government. This issuance clearly demonstrated the benefits of using blockchain in capital-market transactions – it took only one business day to complete the settlement as opposed to five days in the case of conventional bonds.

In the Policy Address delivered last week by the Chief Executive, we announced another piece of good news that we are expanding the Proof-of-Concept Subsidy Scheme to support green fintech. That is bound to expand our green fintech ecosystem, and will further reinforce our status as an international green finance centre.

Going beyond Hong Kong

While our fintech firms have been keen on opening up new markets, we are also stepping up cross-boundary collaboration with our counterparts on the Mainland and elsewhere.

The HKMA, for example, is co-operating with the People’s Bank of China to expand the use of digital renminbi, or e-CNY, in Hong Kong’s cross-boundary retail payments. Recently, an e-CNY pilot project was initiated at the Hangzhou Asian Games for use by the Hong Kong delegation. Members were able to top up their e-CNY wallet via the FPS, our Faster Payment System.

We are encouraging more e-CNY applications – for example, facilitating the use of e-CNY in Hong Kong by Mainland visitors.

And the HKMA and the Bank of Thailand will launch a bilateral linkage between FPS and Thailand’s PromptPay within this year. It will allow Hong Kong residents to make retail payments with the FPS in Thailand, and vice versa for Thai visitors using their PromptPay.

Concluding Remarks

Ladies and gentlemen, I have touched on just a few of the recent developments, and the far-reaching promise, of Hong Kong’s burgeoning fintech sector. Throughout this week of information, intelligence, insight and experience sharing, you will understand why Hong Kong is Asia’s fintech future.

Financial Secretary Paul Chan gave these remarks at Hong Kong FinTech Week 2023 on November 2.