HK, Mainland sign tax pact

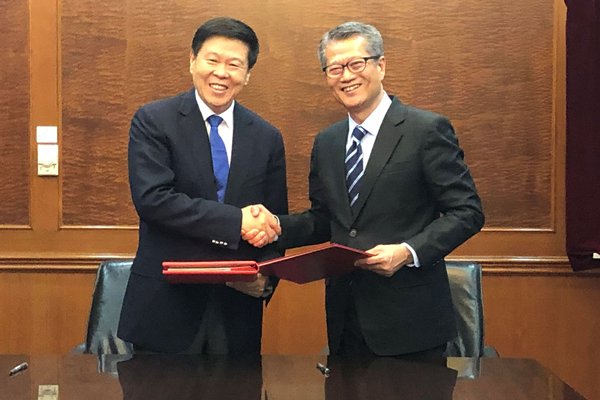

Financial Secretary Paul Chan (right) and State Taxation Administration Commissioner Wang Jun sign the fifth protocol to an agreement for the avoidance of double taxation and the prevention of income tax evasion.

Financial Secretary Paul Chan signed the fifth protocol to an arrangement for the avoidance of double taxation and the prevention of income tax evasion with the Mainland today.

He signed the treaty with State Taxation Administration Commissioner Wang Jun in Beijing.

Mr Chan said the protocol "will provide tax relief to qualified Hong Kong and Mainland teachers and researchers working on the other side. This would promote training, exchanges of talents and co-operation between the two places, and further drive the development of the Guangdong-Hong Kong-Macao Greater Bay Area."

Under the protocol, a qualified teacher or researcher, who is employed in Hong Kong or the Mainland and engages in teaching and research activities on the other side, shall be exempt from taxation on that other side for a period of three years, provided that the relevant income has been subject to tax on the side where the person concerned is employed.

The pact also incorporates into the arrangement measures to prevent tax treaty abuse, which form part of the Base Erosion & Profit Shifting package promulgated by the Organisation for Economic Co-operation & Development in 2015, to ensure that the arrangement follows the latest international standard.

It will come into force after the completion of ratification procedures and notification by both sides.

The arrangement was signed by the Mainland and Hong Kong in 2006 and the two sides further signed the second, the third and the fourth protocols in 2008, 2010 and 2015 respectively to refine the arrangement.